Fire damage can be a devastating experience for homeowners. Beyond the immediate safety concerns and emotional toll, it can also have a significant impact on the value of a property. There are also Quick Sale for Fire Damaged Houses and other ways for homeowners to recover their financial losses due to fire damage, but it’s still important to understand the impact that a fire can have on real estate values. In this article, we’ll explore how fire damage affects property value, helping homeowners and potential buyers better understand what to expect when dealing with fire-damaged homes.

The Immediate Effects

The immediate aftermath of a fire can be a harrowing experience. Flames, smoke, and water used to extinguish the fire can all wreak havoc on a property. These factors can result in visible damage, such as charred walls, soot-covered ceilings, and waterlogged floors. Such visible damage is an immediate red flag for potential buyers and can significantly reduce a property’s market value.

Structural Damage Matters

One of the key factors influencing the impact of fire damage on property value is the extent of structural damage. If the fire has compromised the structural integrity of the home, repairs can be extensive and costly. Buyers are often wary of properties with structural issues, which can lead to a further decrease in value.

Location and Local Real Estate Market

The location of a fire-damaged property plays a crucial role in determining its value. In a hot real estate market, properties tend to sell quickly, even if they have suffered fire damage, as buyers may see potential in the property. However, in a slower market or a neighborhood with an abundance of available homes, the impact on property value can be more significant.

The Extent of Damage and Cleanup Costs

The severity of fire damage can vary greatly. Some fires may cause only minor cosmetic damage, while others can result in extensive destruction. The cost of cleanup and restoration is closely tied to the extent of the damage. More extensive repairs can reduce the property’s value due to the financial investment required to make it habitable again.

Insurance Coverage and Repairs

Homeowners with comprehensive insurance coverage may have an advantage when it comes to repairing fire damage. However, even with insurance, deductibles and the potential for increased premiums can affect the overall financial impact. Understanding the insurance claims process and the extent of coverage is essential for homeowners.

Buyer Perceptions and Disclosure

Buyers often have reservations about purchasing fire-damaged properties. It’s crucial for sellers to be transparent about the history of fire damage and any repairs made. Honest disclosure can build trust with potential buyers and mitigate some of the concerns associated with fire-damaged homes.

In Conclusion

Fire damage can undoubtedly impact the value of a property, but the extent of that impact depends on various factors, including the severity of the damage, location, and local real estate conditions. For homeowners considering selling a fire-damaged property, it’s essential to weigh the costs of repair against the potential selling price and market conditions.…

Hiring in-house cleaning services means that you have to cater for additional salaries, benefits, taxes, and many other expenses. That is after spending significant resources on finding the right cleaners to hire. An easier, more convenient, and cheaper solution is to outsource the cleaning services. Doing so means that you will only need to pay the amount you agree on the contract. That can be a one-time or regular payment. You will also not need to invest in equipment and gear required for cleaning.

Hiring in-house cleaning services means that you have to cater for additional salaries, benefits, taxes, and many other expenses. That is after spending significant resources on finding the right cleaners to hire. An easier, more convenient, and cheaper solution is to outsource the cleaning services. Doing so means that you will only need to pay the amount you agree on the contract. That can be a one-time or regular payment. You will also not need to invest in equipment and gear required for cleaning.

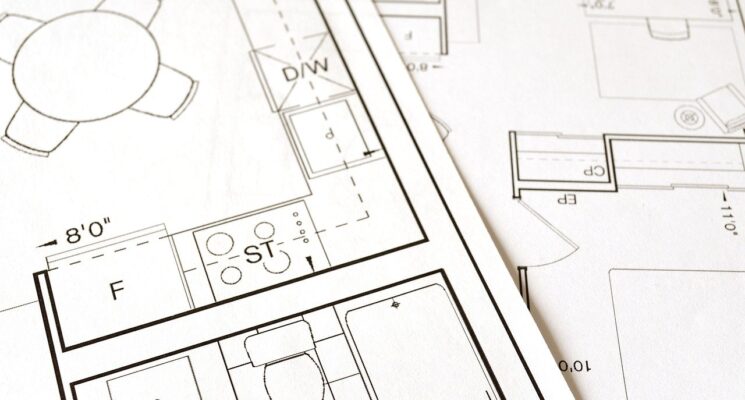

Although this is not the most important thing to consider when selecting a kitchen remodeling company, it is able to provide you with helpful insights about their best practices. The website should have galleries of kitchen remodeling projects along with background information about the company and customer reviews. Look for some things that let you know the company has been in business to develop the reputation they are talking about.

Although this is not the most important thing to consider when selecting a kitchen remodeling company, it is able to provide you with helpful insights about their best practices. The website should have galleries of kitchen remodeling projects along with background information about the company and customer reviews. Look for some things that let you know the company has been in business to develop the reputation they are talking about. Usually, disagreements between customers and kitchen remodeling companies will occur when customers fail to ask the right questions. That does not mean the customer is the one at fault. When you ask the right questions, you will get more information about the materials used, process, warranties, and code regulations. Therefore, you should write down a few questions to ask so to avoid any surprises when the bill comes.

Usually, disagreements between customers and kitchen remodeling companies will occur when customers fail to ask the right questions. That does not mean the customer is the one at fault. When you ask the right questions, you will get more information about the materials used, process, warranties, and code regulations. Therefore, you should write down a few questions to ask so to avoid any surprises when the bill comes.

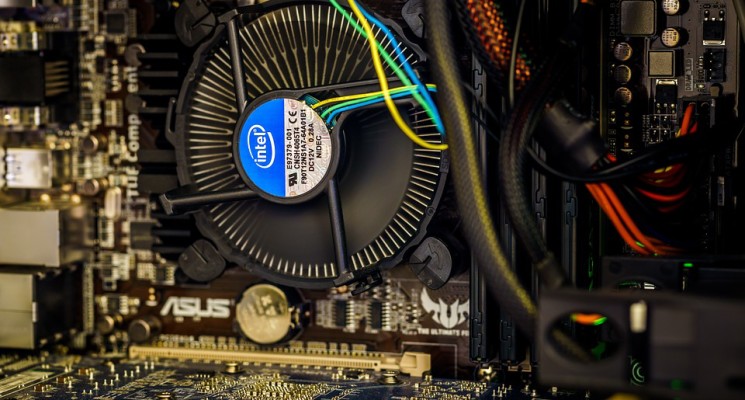

If you want to quality services, then it is good that you choose those companies that are well experienced. This is because they have been in the business long enough to know how to handle every situation that they might encounter. The company should be able to repair your system in such a way that you will not be forced to look for repair soon after they have left. You do not have that money to waste.

If you want to quality services, then it is good that you choose those companies that are well experienced. This is because they have been in the business long enough to know how to handle every situation that they might encounter. The company should be able to repair your system in such a way that you will not be forced to look for repair soon after they have left. You do not have that money to waste. Have you talked to your friends about the idea of having your heating and cooling system repaired? Well, one important thing that you need to understand about a company that has a good reputation is that it will always have many customers around the neighborhood. Talking to your friends about your plans of having your systems repaired can just land you in the right company.…

Have you talked to your friends about the idea of having your heating and cooling system repaired? Well, one important thing that you need to understand about a company that has a good reputation is that it will always have many customers around the neighborhood. Talking to your friends about your plans of having your systems repaired can just land you in the right company.…

already owns. In the real estate market, there are many fully serviced lots set aside by luxury home developers for the construction of luxury custom homes.

already owns. In the real estate market, there are many fully serviced lots set aside by luxury home developers for the construction of luxury custom homes. The builders of custom luxury homes usually develop luxury homes in small units. The potential homeowner of a custom home that is stylish and luxurious will most certainly be building the home for their family.

The builders of custom luxury homes usually develop luxury homes in small units. The potential homeowner of a custom home that is stylish and luxurious will most certainly be building the home for their family.

There are many benefits that you will get to enjoy if you avail of spray foam insulation in Los Angeles. This would make your home more efficient and comfortable at the same time. At the end of the day, you will be very satisfied with how this type of insulation material works.

There are many benefits that you will get to enjoy if you avail of spray foam insulation in Los Angeles. This would make your home more efficient and comfortable at the same time. At the end of the day, you will be very satisfied with how this type of insulation material works.

The bathroom has lots of activities going on there. With tubs and showers, there is humidity and moisture generated there. This moisture is not okay for your home and specifically for the health of people in your home. The most efficient way of getting rid of these is installing a bathroom fan. If you don’t have any ventilation or a fan you probably know how it feels like. You are quite familiar with fogged mirrors walls and counter tops with the moist coating.

The bathroom has lots of activities going on there. With tubs and showers, there is humidity and moisture generated there. This moisture is not okay for your home and specifically for the health of people in your home. The most efficient way of getting rid of these is installing a bathroom fan. If you don’t have any ventilation or a fan you probably know how it feels like. You are quite familiar with fogged mirrors walls and counter tops with the moist coating. Living in a house without a bathroom fan can be a nightmare. Some people may deal with fogged mirrors while to others it is unpalatable. Though it is a little expensive to invest in bathroom fans, it is wise to invest in them. If you have steam showers, for instance, bathroom fans plus ventilation are a necessity. The bottom line is if you don’t have a fan in your bathroom you better get one.…

Living in a house without a bathroom fan can be a nightmare. Some people may deal with fogged mirrors while to others it is unpalatable. Though it is a little expensive to invest in bathroom fans, it is wise to invest in them. If you have steam showers, for instance, bathroom fans plus ventilation are a necessity. The bottom line is if you don’t have a fan in your bathroom you better get one.…

owever, for those with less space can also find a solution to working with the space that they have by having small sections of different clothes. This can be done by either hanging or use of shelves and drawers

owever, for those with less space can also find a solution to working with the space that they have by having small sections of different clothes. This can be done by either hanging or use of shelves and drawers

Pick an interior décor color scheme for your bathroom and work around it together with the renovation experts. At this point, you can decide on some affordable add-ons to make the restoration design complete with a modern outlook, which you can project with the help of a freestanding bathtub. The tub could be white, green or pink in color. The choice is yours as bathroom overhauls are about leaving your signature on a structural and interior décor design that depicts your beauty aspirations.

Pick an interior décor color scheme for your bathroom and work around it together with the renovation experts. At this point, you can decide on some affordable add-ons to make the restoration design complete with a modern outlook, which you can project with the help of a freestanding bathtub. The tub could be white, green or pink in color. The choice is yours as bathroom overhauls are about leaving your signature on a structural and interior décor design that depicts your beauty aspirations.

They will come to your old home and start loading your belonging the way you want them to be loaded. They will cover your things, so they don’t get scratched up. The nice thing about their staff is they know how to stack your stuff to get the most out of your money. They will only have to make one trip; this will allow you to be able to drive your own car or truck to your new home.

They will come to your old home and start loading your belonging the way you want them to be loaded. They will cover your things, so they don’t get scratched up. The nice thing about their staff is they know how to stack your stuff to get the most out of your money. They will only have to make one trip; this will allow you to be able to drive your own car or truck to your new home. If the new home that you moved into isn’t as big, or you just need time to arrange things around, the company will also store your items that you don’t have space for in their warehouse. They will store them as long as you need them too. Their warehouse has a guard who works 24-7, so your belongings will be safe.…

If the new home that you moved into isn’t as big, or you just need time to arrange things around, the company will also store your items that you don’t have space for in their warehouse. They will store them as long as you need them too. Their warehouse has a guard who works 24-7, so your belongings will be safe.…

By choosing to hire a commercial roofing company, you should try to find one locally; this will make it a lot easier for when you need extra materials. You won’t have to wait for them to order and shipped to you. Most local roofing company will also buy their materials locally.

By choosing to hire a commercial roofing company, you should try to find one locally; this will make it a lot easier for when you need extra materials. You won’t have to wait for them to order and shipped to you. Most local roofing company will also buy their materials locally. When you hire a roofing company, they will come over and make a list of items that will be needed to be repaired. They will ask if you want to buy the materials or if you want them to get the supply. They will offer you their own building inspector or if you have someone else in mind.

When you hire a roofing company, they will come over and make a list of items that will be needed to be repaired. They will ask if you want to buy the materials or if you want them to get the supply. They will offer you their own building inspector or if you have someone else in mind.

causes that might make the pests invade the interior of your home is the lack of moisture outside. Many of them need moisture so as to survive.

causes that might make the pests invade the interior of your home is the lack of moisture outside. Many of them need moisture so as to survive. When selecting pesticides, it is critical to establish whether its use is appropriate. Secondly, it is advisable to use the non-chemical pest control measures, especially where children and pets are involved.

When selecting pesticides, it is critical to establish whether its use is appropriate. Secondly, it is advisable to use the non-chemical pest control measures, especially where children and pets are involved.

thod, a powder is mixed with cleaning agents and special solvents which are worked into the fiber using a machine that is fitted with rotating brushes. The chemical used absorbs the dirt on the carpet, and it is vacuumed up after it settles in the carpet for about 15 minutes.

thod, a powder is mixed with cleaning agents and special solvents which are worked into the fiber using a machine that is fitted with rotating brushes. The chemical used absorbs the dirt on the carpet, and it is vacuumed up after it settles in the carpet for about 15 minutes.

he patio is made of concrete, it means we conserve the environment since we do not have to fell trees to make our patio. It also eliminates the need for regular maintenance using wood sealers and stains that are solvent based which may be potentially harmful to the environment.

he patio is made of concrete, it means we conserve the environment since we do not have to fell trees to make our patio. It also eliminates the need for regular maintenance using wood sealers and stains that are solvent based which may be potentially harmful to the environment.

ce. – Make sure any perennial week and small stones are removed and rake the garden to a level.

ce. – Make sure any perennial week and small stones are removed and rake the garden to a level. ur new turf

ur new turf

The heating installer should be offering affordable prices to the homeowners. The cost includes both the purchase prices of the heating equipment as well as the service

The heating installer should be offering affordable prices to the homeowners. The cost includes both the purchase prices of the heating equipment as well as the service

pressure or the steam is used to force water through the coffee grounds thus producing the espresso.

pressure or the steam is used to force water through the coffee grounds thus producing the espresso. The difference between the two lies in the time that will be required to make the coffee and how skilled or trained the coffee maker is. The semi-automatic espresso machine is perfect for the espresso connoisseur. These are individuals who love taking time when making their coffee. It requires a little more work than just letting the coffee machine do it work.

The difference between the two lies in the time that will be required to make the coffee and how skilled or trained the coffee maker is. The semi-automatic espresso machine is perfect for the espresso connoisseur. These are individuals who love taking time when making their coffee. It requires a little more work than just letting the coffee machine do it work.

because of their light weight compared to other photo frames. They are also optically and water resistant.

because of their light weight compared to other photo frames. They are also optically and water resistant. Whether the photos displayed are those of your children playing in the neighborhood or your childhood memories, these pictures will always be precious. These are especially perfect for the fireplace mantle. Get creative with how you display the photos. You could place random photos of each family member at different ages next to each other.

Whether the photos displayed are those of your children playing in the neighborhood or your childhood memories, these pictures will always be precious. These are especially perfect for the fireplace mantle. Get creative with how you display the photos. You could place random photos of each family member at different ages next to each other.

energy. You do not get the temperatures you desire, and yet you will be paying lots of power bills. The vent free conditioner works on a similar principle, but hot air is passed through a moist membrane.

energy. You do not get the temperatures you desire, and yet you will be paying lots of power bills. The vent free conditioner works on a similar principle, but hot air is passed through a moist membrane. There are varieties of these conditioners. Your preferences, needs, and favorite models will determine the choice you make at the end of the day.

There are varieties of these conditioners. Your preferences, needs, and favorite models will determine the choice you make at the end of the day.